Comptroller Kevin Lembo Archive > News

COMPTROLLER LEMBO PROJECTS $122.4-MILLION DEFICIT, DEPENDENT ON STATE'S ABILITY TO MEET PLANNED SAVINGS TARGETComptroller Kevin Lembo reported today that, after accounting for about $102.8 million in rescissions announced in September and the updated consensus revenue forecast announced last month, the state is on track to end the current fiscal year with a $122.4-million deficit.

This projection increases the deficit by $4 million over last month's projection, Lembo said.

In a letter to Gov. Dannel P. Malloy, Lembo said the Office of Policy and Management's (OPM) latest deficit projection is feasible based on OPM's past success in achieving overall budgeted savings goals. However, Lembo said the ongoing collaborative deficit-mitigation talks involving the administration and legislative leaders are correct in targeting between $350 million to $370 million in light of troubling economic trends over the past two months.

"I am very concerned about more recent disruptions to the state's positive economic trends," Lembo said. "Of greatest concern are the last two consecutive months of state job losses and the related negative impact on the withholding portion of the income tax."

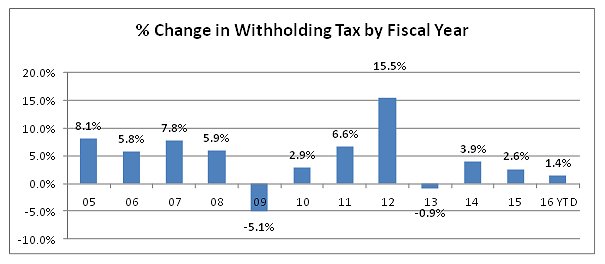

Withholding accounts for a majority of the state's income tax receipts and about 40 percent of total General Fund revenue, Lembo said. In Fiscal Year 2005, as the economy continued to expand, the withholding portion of the income tax grew at a rate of 8.1 percent. Over the past three years, the growth has been below 4 percent. On a year-to-date basis, through October, it was up just 1.4 percent.

"If this trend does not improve in the near term, additional downward adjustments to revenue will be required," Lembo said. "I therefore support the use of $350 million as a reasonable deficit mitigation target."

OPM has estimated achieving $303.4 million in savings this fiscal year – a feasible target considering that the state has achieved an average of $326.4 million in General Fund budget savings per year over the past three fiscal years. Lembo said significant savings have been realized in debt service due to low borrowing costs and the related bond premiums received by the state Treasurer.

"An increase in interest rates will limit the state's ability to realize future savings in debt service," Lembo said. "I am hopeful that the ongoing budget negotiations will produce the policy revisions necessary for OPM to attain the lapse target included in the current projections."

Lembo said there are several economic factors that will continue to influence the state budget going forward and must be watched.

"The state is likely to continue to experience significant budget pressure until the withholding portion of the income tax resumes a normal expansionary growth trend," Lembo said. "Part of the state's slow withholding growth can be attributed to the distribution of job gains by employment sector during this recovery. The financial services sector pays wages that are more than 50 percent above the statewide average for all sectors – however, the financial services sector remains 14,700 jobs (10 percent) below its pre-recession level.

"At the same time, the leisure and hospitality sector that pays wages 46 percent below the statewide average for all sectors has added 19,200 jobs (14 percent) to its pre-recession level.

"There are additional budgetary risk factors that bear watching. Our state economy is linked to the national economy which, in turn, is dependent on the global economy. Global economic events have generally constrained domestic growth."

Lembo pointed to some of the latest economic indicators from federal and state Departments of Labor and other sources that show:

EMPLOYMENT

• Through October, year-to-date income tax withholding receipts were running

1.4 percent above the same period last year. New tax rate tables incorporating

the higher rate structure, as adopted in PA 15-244, were required to be

implemented by the end of August. Therefore, beginning September 2015 receipts

have incorporated the higher tax rates. In the month of October, income tax

withholding receipts dropped almost 3 percent from the same month last year.

• Withholding receipts are the largest single source of state tax revenue,

accounting for 61 percent of the total income tax receipts in Fiscal Year 2015

and almost 40 percent of total General Fund tax receipts in that year. As the

graph below shows, with the exception of the increases experienced in Fiscal

Years 2011 and 2012 that resulted from tax increases, withholding growth has

been well below normal post-recession levels.

• The Nov. 10 consensus revenue forecast projects income tax withholding growth

of 3 percent. If the current withholding trend continues, further downward

adjustments will be required to the income tax projections.

• According to the Department of Labor, preliminary October non-farm

employment estimates from the U.S. Bureau of Labor Statistics (BLS) payroll

survey (seasonally adjusted) indicated that Connecticut lost 2,200 jobs in

October, bringing payroll employment to a level of 1,694,100. This is the second

monthly state non-farm jobs decline in six months. Losses have been posted in

the last two months, bringing the two-month job loss total to 7,000 positions.

Connecticut is now estimated to have added 24,100 non-farm positions over the

last 12 months, which is a fairly typical gain during a period of moderate

economic expansion.

• Connecticut has now recovered 100,100 positions, or 84.1 percent of the

119,000 seasonally adjusted total non-farm jobs that were lost in the state

during the March 2008 - February 2010 employment downturn. Connecticut's jobs

recovery is now 68 months old and is averaging about 1,472 new jobs per month

since February 2010. Connecticut is one of 12 states that have not yet recovered

from the recessionary job losses.

• U.S. employment has been advancing at a rate of 2 percent over the 12-month

period ending in October; Connecticut's employment growth was 1.4 percent for

the same period.

• Connecticut's unemployment rate was 5.1 percent in October; the national

unemployment rate was 5.0 percent. Connecticut's unemployment rate has continued

to decline from a high of 9.5 percent in October 2010.

• There were 97,000 unemployed job seekers in Connecticut. A low of 36,500

unemployed workers was recorded in October of 2000. The number of unemployed

state workers hit a recessionary high of 177,200 in December of 2010.

• According to Georgetown University Center on Education and the Workforce,

about 23 percent of 18 to 34 year olds are underemployed nationally. This trend

is a factor in lackluster wage growth since the end of the recession.

Wage and Salary Income

• The Department of Labor reports that average hourly earnings at $29.47, not

seasonally adjusted, were up $1.15, or 4.1 percent, from the October 2014

estimate. The resulting average private-sector weekly pay was figured at

$993.14, up $35.92, or 3.8 percent higher than a year ago. The differential

between the growth in hourly wages and weekly pay results from a reduction in

hours worked.

• The 12-month percent change in the Consumer Price Index for All Urban

Consumers (CPI-U, U.S. City Average, not seasonally adjusted) in October 2015

was 0.2 percent (unchanged).

• The graph below shows the monthly percent change from the prior year in

Connecticut private-sector weekly earnings. Connecticut and the nation as a

whole have struggled with stagnant wage growth. This graph provides monthly data

through October of 2015.

• One reason for the slow growth in statewide wages during this recovery has

been the distribution of job gains by sector.

• The financial services sector pays wages that are more than 50 percent above

the statewide average for all sectors. But the financial services sector remains

14,700 jobs (10 percent) below its pre-recession level. At the same time, the

leisure and hospitality sector that pays wages that are 46 percent below the

statewide average for all sectors has added 19,200 jobs (14 percent) to its

pre-recession level.

• The area between the two lines below illustrates the wage gap between the

financial sector that is still struggling to recover from the recession, and the

leisure and hospitality sector that has far surpassed its pre-recession job

numbers.

• Slow wage growth has placed pressure on the state budget, and on the growth

of the larger economy.

• The reversal in the state's job growth trend over the past two months and the

slow wage growth are the largest contributing factors to the growing FY 16

General Fund deficit projections.

• Based on second-quarter data from the Bureau of Economic Analysis released on

Sept. 30, Connecticut ranks 14th nationally in income growth. The chart below

shows the annual trend in Connecticut personal income over time.

Housing

• According to Connecticut Realtors, October single family home sales in the

state increased 5.7 percent from the prior year's October. At the same time, the

median home price declined from$242,000 to $239,900. Condominium sales were down

9.9 percent in October compared to the same period a year earlier. The median

sale price for townhouses and condominiums last month was $157,500, which was

down 4.5 percent from October 2014.

• Nationally, October sales of single family homes grew 4.6 percent over last

October. The median existing single-family home price was $221,200 in October,

up 6.3 percent from October 2014. Existing condominium and co-op sales declined

1.6 percent. The median existing condo price was $207,100 in October, which is

1.6 percent above a year ago.

Consumers

• The Conference Board's Consumer Confidence Index fell to 90.4 in November,

missing estimates for 99.5. This was the lowest reading since September 2014. It

was also lower than October's level of 99.1. Heading into 2016, consumers are

cautious about the labor market and expect little change in business conditions.

The decline in the confidence index comes after a robust month of hiring in

October. Employers added 271,000 jobs last month as the unemployment rate

settled at 5 percent. The drop in confidence concerns retailers heading into the

holiday season.

• Recently, low gasoline prices have slowed retail sales gains. This trend

continued in October, but core retail sales that exclude the volatile components

of gasoline and car sales showed a stronger level of consumer activity. Core

sales increased 0.3 percent, close to the 0.4 percent economists had projected

for the month.

• Sales at gasoline stations fell 0.9 percent as prices continued to tumble. And

auto sales declined 0.5 percent. But other purchases increased at a solid rate.

Sales rose 0.4 percent at furniture stores, 0.7 percent at health and personal

care stores, and 0.4 percent at sporting goods outlets. Those were partly offset

by a 0.4-percent drop at electronics and appliance stores and 0.4-percent drop

at general merchandise stores.

• Solid retail sales are a major reason that economists expect the Federal

Reserve to raise interest rates within the next few months for the first time in

nearly a decade.

• According to the Federal Reserve, consumer borrowing by households rose at a

faster pace in September on increased lending for auto purchases and bigger

credit-card balances.

• The $28.9-billion jump in total credit followed a $16-billion gain in the

previous month, Federal Reserve figures showed Friday. Non-revolving debt, which

includes funding for college tuition and auto purchases, was up $22.2 billion,

the most since July 2011.

• The pickup in non-revolving credit in September followed a $12-billion

increase the previous month. Revolving debt increased by $6.7 billion, the

biggest gain in three months.

Business and Economic Growth

• According to the Nov. 24 second estimate by the Bureau of Economic Analysis,

GDP increased at an annual rate of 2.1 percent in the third quarter of 2015.

This is an improvement from the advance estimate that had growth for the quarter

at 1.5 percent. In the second quarter, real GDP increased 3.9 percent.

• The upward growth estimate was due to upward revisions to business spending on

equipment and investment in home building. In addition, inventory reductions by

businesses were not as aggressive as first expected. While consumer spending was

revised down a bit, its pace remained brisk.

• The GDP growth rate has not attained a 3-percent level since the end of the

recession. Based on present trend, GDP growth will remain below the 3-percent

level in 2015.

• Corporate profits dropped 1.1 percent in the July-to-September period and were

down 4.7 percent from a year earlier, the weakest annual reading since the final

months of the recession.

• The drop largely reflects pressure on U.S. corporations' overseas operations

due to a stronger dollar and weak global demand.

• Forbes recently dropped Connecticut's ranking to 39th in the nation in its

"2015 Best States for Business" rankings. The report cited high business costs,

a restrictive regulatory environment and a weak economic climate. Connecticut

had a particularly poor showing in certain areas. The state came in 45th when it

came to business costs, 44th in economic climate, and 41st in regulatory

environment.

• In a survey administered for InformCT by the Connecticut Economic Resource

Center, Inc. (CERC) and Smith & Company, a growing majority of state residents

believe the economy in Connecticut is stagnating. The proportions of respondents

who would make a major purchase, or buy/refinance a home has dropped

substantially, while those who are concerned about the affordability of health

insurance has risen slightly, from 53 percent to 55 percent. Slightly more

respondents – now nine in 10 – believe there are not enough jobs and jobs are

difficult to get, and more people believe it will get worse or stay the same.

Despite the negative outlook, 51 percent of residents believe Connecticut is a

good place to live and raise a family. However, a third of the respondents also

indicated that a move outside of the state is likely.

Stock Market

• Estimated and final income tax payments account for approximately 40 percent

of total state income tax receipts. These payments show a correlation to

activity in equity markets relating to capital gains.

• Estimated income tax receipts increased 5.3 percent in Fiscal Year 2015

compared to the prior fiscal year. The first significant month of estimated

payment receipts for Fiscal Year 2016 is September. Through September estimated

payments were accelerating at a 6.8-percent rate over the same period last

fiscal year. The bulk of final payments are received in April, so trend analysis

at this point is not especially revealing.

• Over the past several years, the state has experienced significant

fluctuations in capital-gains-related receipts. In late 2012, investors turned

over a large volume of long-term capital gains to take advantage of the expiring

15-percent tax rate, which increased to a top long-term rate of 23.8 percent

(20-percent rate plus 3.8 percent on AGI above $200,000 related to the ACA) on

January 1, 2013. As a result, the state realized a windfall on the

capital-gains-driven portion of the income tax in Fiscal Year 2013. Because this

left little in unrealized gains, this component of the income tax experienced a

sharp drop in Fiscal Year 2014. As the market surged, investors were reluctant

to take short-term gains because such gains are taxed at the higher ordinary

income rate.

• It is difficult to assess the impact that the market correction cycle will

have on state revenue given the behavior changes that investors have made in the

face of federal tax changes.

• December/January estimated payment activity will provide additional data to

assess the impact of market activity on state receipts.

• The graph below shows the market activity and recovery in the Dow over the

past six months.

***END***