May 1, 2023

The Honorable Ned Lamont

Governor of the State of Connecticut

State Capitol

Hartford, Connecticut

Dear Governor Lamont,

Economic Indicators

I write to provide you with financial statements for the General Fund and the Transportation Fund through March 31, 2023. The Office of the State Comptroller (OSC) is projecting the General Fund will end Fiscal Year 2023 with a $1.58 billion surplus, an increase of $147.1 million from last month, and the Special Transportation Fund will end Fiscal Year 2023 with a $248.8 million surplus, an increase of $11.4 million from last month.

The following analysis of the financial statements furnished by OPM is provided pursuant to Connecticut General Statutes (CGS) Section 3-115. The Office of the State Comptroller is in general agreement with OPM’s General Fund and Special Transportation Fund projections which reflect the consensus revenue forecast reached with the Office of Fiscal Analysis (OFA) on May 1, 2023.

General Fund

The consensus revenue forecast projected General Fund revenues are now $163.1 million higher than estimated by OPM on April 20. Several revenue accounts have exceeded their target including Corporation Tax ($100 million), Pass-through Entity Tax ($60 million), Escheatment Revenue ($52.5 million) and the Sales and Use Tax ($35 million). The Estimates & Finals component of the Personal Income Tax was revised downward by $560 million due to April tax receipts, and Federal Grant revenue was also revised downward by $62.8 million due to the timing of expected reimbursements. All other revenue changes netted to a positive $38.4 million change in revenue. Due to the changes in Estimates & Finals and the Pass-through Entity Tax noted above, the volatility transfer to the Budget Reserve Fund pursuant to Connecticut General Statutes Section 4-30a will decrease to a total of $1.35 billion from $1.85 billion. There were no material changes to the expenditure forecast.

Special Transportation Fund

The Special Transportation Fund surplus is projected to be $248.8 million, an increase of $9.7 million from what was estimated by OPM on April 20. Sales and Use Tax was revised upward by $12.5 million due to similar trends from what was seen in the General Fund. Partially offsetting the surplus was a $10 million downward revision in Highway Use, as collections from the first two months of this new tax came in below expectations. All other revenue changes netted to a positive $9.7 million.

Budget Reserve Fund

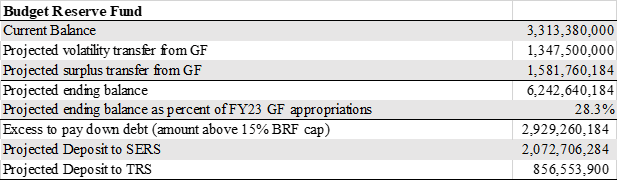

The statutory revenue volatility cap requires receipts above a certain level to be transferred to the Budget Reserve Fund (BRF). OSC is currently projecting approximately $2.9 billion would be available to reduce unfunded pension liability for the State Employee Retirement System (SERS) and the Teachers’ Retirement System (TRS).

Economic Indicators

After the continued Federal Reserve Interest Rate increases and the two United States bank failures in March, April appeared to be a relatively quiet month from an economic perspective. While a few lenders missed 1st quarter earnings estimates, overall banks confirmed the continued health of the banking sector.

The were no Federal Reserve interest rate decisions in April, with the next decision scheduled for May 3rd. Economists anticipate a 25-basis-point increase rate increase in May, and that the Federal Reserve will then hold rates steady for the rest of the year.

Federal Reserve Chair Powell has remarked that “a large and variable lag†exists between the implementation of monetary policy and broad macroeconomic aggregates. Labor market data is often among the last of economic data to react to the Fed’s efforts and continues to show mixed results. In addition, the COVID pandemic and efforts to minimize the damage it might have otherwise done to the global economy has resulted in distortions to labor market and other economic data.

The economy added another 236,000 jobs in March. Unemployment decreased from 3.6% to 3.5% in March. United States unemployment claims were higher in April (245,000 as of the latest Unemployment Insurance Weekly Claims report). However, the long-term average is closer to 350,000, and additionally there was a change in how the Department of Labor applies its seasonal adjustment factor now that COVID-related disruptions have faded that resulted in higher initial claims. Job openings fell to 9.93 million in March (the first sub-10 million total in nearly 10 years), but unemployment is 5.9 million so there is still more than 1 job for every unemployed person.

The Bureau of Labor Statistics reported the Consumer Price Index (CPI) rose 0.1% in March on a seasonally adjusted basis, after increasing 0.4% in February. Over the last 12 months, the all-items increased 5.0%, down from 6.0% in February. However, at least some of the improvement in inflation can be traced to last year’s huge increase in energy prices related to Russia’s invasion of Ukraine, with Gasoline and Fuel Oil down 17.4% and 14.2% respectively.

The National Association of Realtors (NAR) reported existing-home sales fell 2.4% in March and was also 22.0% below last year. The median existing-home sales price was $375,700 in March, a little higher than February but a decline of 0.9% from March 2022. Year-over-year rent growth is continuing to decelerate and now stands at 2.6%, its lowest level since April 2021. The vacancy index now stands at 6.6%, its highest reading in two years.

My office also issues an Annual Comprehensive Financial Report as an accounting supplement to the budgetary report. This annual report includes financial statements for all state funds and component units prepared in accordance with Generally Accepted Accounting Principles (GAAP). From a balance sheet perspective, the GAAP unassigned fund balance in the General Fund was a negative $771.5 million as of June 30, 2022.

If you have any questions on this report, please do not hesitate to contact me.

Sincerely,

Sean Scanlon

State Comptroller