February 1, 2023

The Honorable Ned Lamont

Governor of the State of Connecticut

State Capitol

Hartford, Connecticut

Dear Governor Lamont,

I write to provide you with financial statements for the General Fund and the Transportation Fund through December 31, 2022. The Office of the State Comptroller (OSC) is projecting the General Fund will end Fiscal Year 2023 with a $1.3B surplus and the Special Transportation Fund will end Fiscal Year 2023 with a $237.7 million surplus. OSC is in general agreement with OPM’s General Fund and Special Transportation Fund projections. The following analysis of the financial statements furnished by the Office of Policy and Management (OPM) is provided pursuant to Connecticut General Statutes (CGS) Section 3-115.

General Fund

The General Fund surplus is projected to be $1.3 billion which is an increase of $324.7 million from last month’s projection. This month’s estimate includes revisions consistent with the consensus revenue estimates provided by OPM and the Office of Fiscal Analysis (OFA) on January 17th.

Projected FY23 revenue were revised upwards by $265.3 million, primarily driven by the Withholding component of the Personal Income Tax ($125 million), the Corporation Tax ($87.5 million), and Federal Grants ($81.3 million).

Projected FY23 expenditures were revised downwards by $59.4 million primarily due to extension of the public health emergency declaration by the federal government into January 2023 and several Personal Service accounts expected to lapse due to vacancies.

Special Transportation Fund

The Special Transportation Fund surplus is projected to be $237.7 million, an increase of $11.1 million from last month’s projection due to a $9.9 million increase in revenue and $1.2 million improved expenditure forecast.

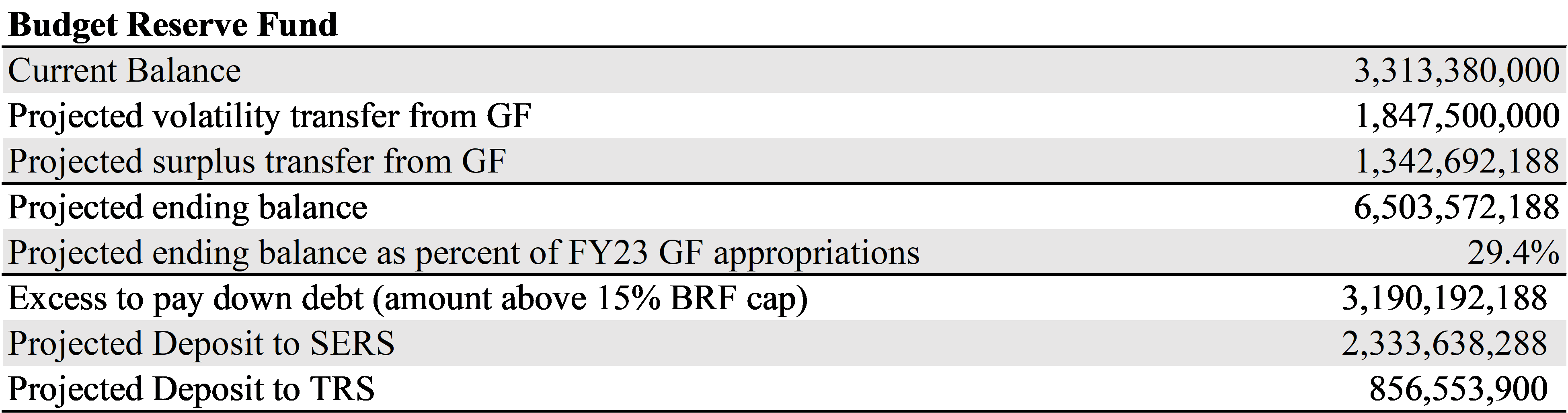

Budget Reserve Fund

The statutory revenue volatility cap requires receipts above a certain level to be transferred to the Budget Reserve Fund (BRF). OSC is currently projecting approximately $3.2 billion would be available to reduce unfunded pension liability for the State Employee Retirement System (SERS) and the Teachers’ Retirement System (TRS).

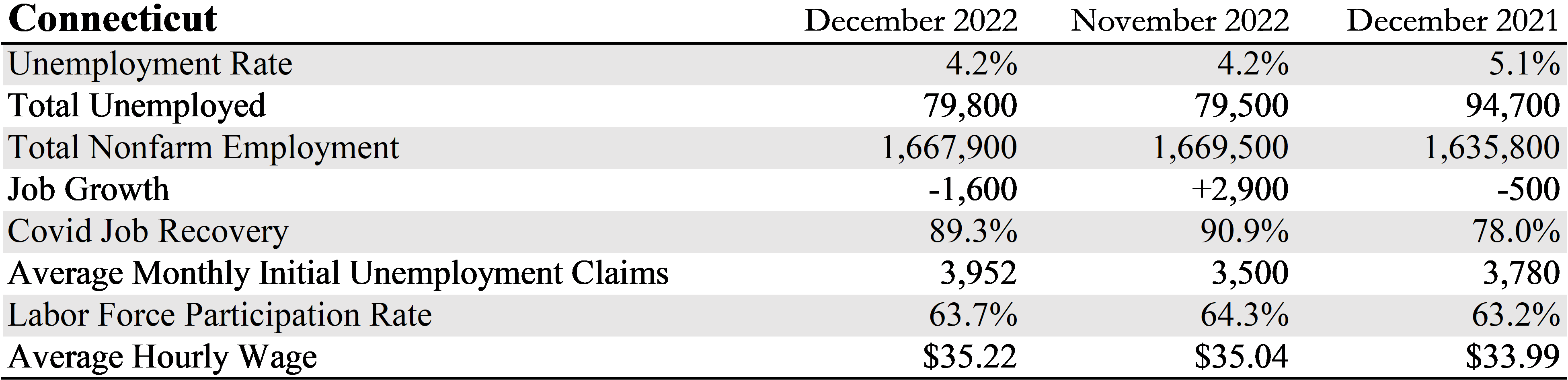

Economic Indicators

The big question on the mind of many is whether or not the United States is in a recession. Two consecutive quarters of declining Gross Domestic Product (GDP) represent a recession to many observers, but after 1.6% and 0.6% real GDP decreases in the 1st and 2nd quarter of 2022 respectively, 3rd quarter GDP increased at an annual rate of 3.2% and 4th quarter GDP increased at an annual rate of 2.9%. The stock market rallied in January after we narrowly avoided a bear market in 2022. Meanwhile the United States labor market remains unnaturally strong, with low unemployment and approximately 1.75 job openings for each available worker (but recent layoffs are a sign the labor market may be righting itself). Pending home sales fell 38.6% in 2022, driven by lack of inventory, elevated home prices, and rising mortgages. However, the national median existing home-sales price was down for the sixth month in a row in December, and median rent declined for the fourth month in a row. The Consumer Price Index (CPI) declined 0.1 percent in December, for a 12-month percent increase in CPI of 6.5 percent, a sign that inflation is slowly coming down after the Federal Reserve increased interest rates several times in 2022 in order to combat inflation.

We saw Connecticut numbers moderate in December. After 11 months of job growth, Connecticut payroll jobs declined 0.1% with December down 1,600 jobs. The Connecticut Department of Labor reported the state unemployment rate remained steady at 4.2% in December. The total number of unemployed people was 79,800 in December, an increase of 300 from last month. Unemployment claims for first-time filers were an average of 3,952 per week in December, up by 452 claims from last month.

My office also issues an Annual Comprehensive Financial Report as an accounting supplement to the budgetary report. This annual report includes financial statements for all state funds and component units prepared in accordance with Generally Accepted Accounting Principles (GAAP). From a balance sheet perspective, the GAAP unassigned fund balance in the General Fund was a negative $660.7 million as of June 30, 2021.

If you have any questions on this report, please do not hesitate to contact me.

Sincerely,

Sean Scanlon

State Comptroller