December 2, 2024

The Honorable Ned Lamont

Governor of the State of Connecticut

State Capitol

Hartford, Connecticut

Dear Governor Lamont,

I write to provide you with financial statements for the General Fund and the Transportation Fund through October 31, 2024. The Office of the State Comptroller (OSC) is projecting the General Fund will end Fiscal Year 2025 with a $190.3 million surplus and the Special Transportation Fund will end Fiscal Year 2025 with a $149.0 million surplus. OSC is in general agreement with the Office of Policy and Management’s (OPM’s) General Fund and Special Transportation Fund projections. The following analysis of the financial statements furnished by OPM is provided pursuant to Connecticut General Statutes (CGS) Section 3-115

General Fund

The FY 2025 General Fund surplus is projected to be $190.3 million, which is $119.1 million higher than last month’s projection and $107.5 million lower than budgeted. The change from last month is mainly due to upward revisions to net revenues. Additionally, net expenditure projections were revised lower by $10.6 million, increasing the projected surplus.

The November consensus forecast between OPM and the Office of Fiscal Analysis (OFA) increased General Fund revenues by a net $108.5 million from the previous month’s estimate. The two taxes subject to the volatility cap, the Estimates and Finals portion of the Personal Income Tax and the Pass-through Entity Tax, were revised upwards by $150.0 million and $90.0 million, respectively. The transfer to the Budget Reserve Fund is projected to increase by $240.0 million as a result. The withholding portion of the personal income tax was revised up by $95.0 million due to continued resilience in the labor market, and federal grant revenue is projected to be $72.4 million higher. Partially offsetting these increases, the health provider tax was revised lower by $50.0 million based on lower collections from hospitals, and the combined revision from all other revenue categories nets to -$8.9 million.

Net expenditures are currently projected to exceed budgeted levels by $383.7 million. In continuation of FY 2024 trends, the largest anticipated overages relate to the Department of Social Services Medicaid account and the State Comptroller-fringe benefits higher education Alternative Retirement System account

Special Transportation Fund

The Special Transportation Fund (STF) is projected to close FY 2025 with a $149.0 million operating surplus, an increase of $17.4 million from last month’s projection. While consensus revenue forecasts lowered projected revenues by $54.2 million from last month, anticipated expenditures were revised downwards by $71.6 million, more than offsetting the lower revenues. Lower spending on debt service and lower revenue from the Oil Companies Tax are the primary reasons. Following the use of a portion of the STF fund balance described below and FY 2025 operations, the STF closing balance is projected to be $560.6 million, as of June 30, 2025

Public Act No. 24-151 requires the portion of the FY 2024 year-end STF fund balance above 18 percent of FY 2025 net appropriations be used to reduce the state’s transportation-related indebtedness. That amount is currently projected to equal $526.9 million

Budget Reserve Fund

For the closeout of FY 2024, $933 million is estimated to be transferred out of the Budget Reserve Fund (BRF) and into the State Employees’ and Teachers’ Retirement systems this year.

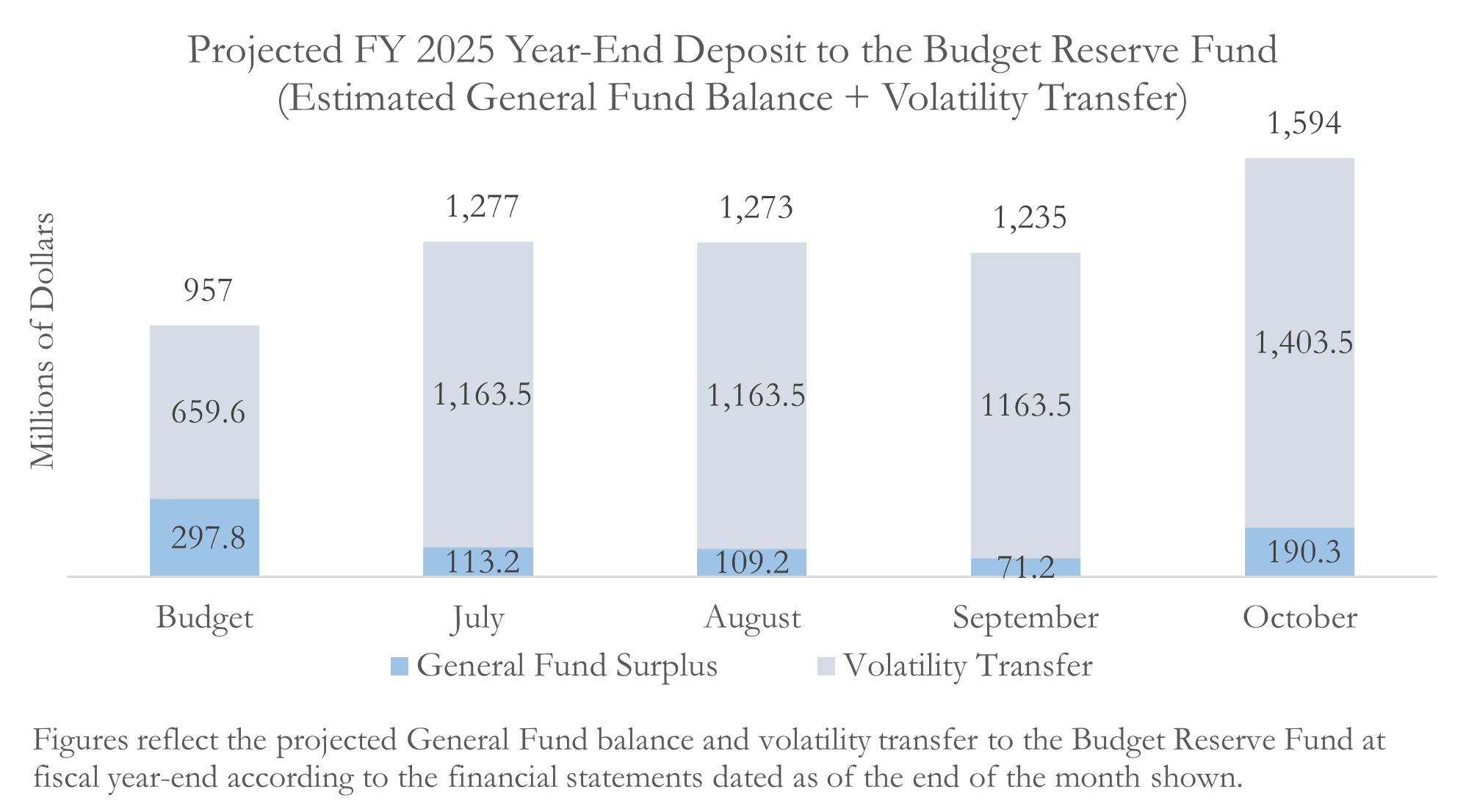

For FY 2025, year-end transfers totaling $1.59 billion from the volatility cap deposit and operating surplus are projected to increase the BRF balance to 25.0 percent of General Fund appropriations. Since the statutory cap for the BRF is 18 percent, the projected balance is anticipated to result in additional transfers to the retirement funds during the closeout of FY 2025.

Economic Indicators

The U.S. economy continues to grow at a moderate pace, with third quarter real gross domestic product (GDP) growing at a 2.8 percent annual rate according to revised estimates. Compared to other major economies, the U.S. looks exceptional. Job growth has slowed but the unemployment rate remains low at 4.1 percent nationally. Connecticut’s labor market is tighter, with October’s unemployment rate at only 3.0 percent, the lowest since August 2001.

Retail sales continue to show momentum heading into the holiday shopping season, growing 0.4 percent month-over-month in October after 0.8 percent growth in September. Consumer spending is becoming increasingly stratified, with affluent households driving growth while lower-income families are more impacted by accumulated price increases and debt burdens at high interest rates.

Housing affordability continues to be a key challenge. Connecticut home prices have risen more than 60 percent since 2019. The average interest rate on a 30-year, fixed rate mortgage stands at 6.84 percent. Together rising prices and rising interest rates have substantially increased housing costs, with the typical U.S. household needing to spend approximately 36 percent of their monthly income on mortgage payments to buy the median-priced U.S. home in 2024, compared to 26 percent in 2019, assuming a 5 percent downpayment

The rental market tells a similar story of rising costs and limited supply, especially for low-income households. While national median rents have actual fallen year-over-year, Connecticut saw median new lease rent growth of 5.2 percent year-over-year in October according to Apartment List. The state’s rental vacancy rate is 3.2 percent, far lower than 6.9 percent nationally. According to the National Low Income Housing Coalition, families need to earn about $72,000 per year to afford a two-bedroom rental in Connecticut, and the state is short more than 98,000 units available and affordable for very low-income families

With the November elections in the rear-view mirror, consumer confidence, the stock market, and the value of the U.S. dollar are all up this month on expectations for the incoming Trump administration. The Consumer Price Index (CPI) ticked up slightly to 2.6 percent in October, but inflation is expected to continue to trend downwards towards the Federal Reserve’s 2 percent target. Trump’s stated aims of deregulation, tax cuts, new tariffs, and mass deportations could all contribute to inflation pressures next year given the current economic environment.

The Federal Reserve may cut interest rates by another 25 basis points in December, following rate cuts in September and November that lowered the federal funds rate to 4.5 to 4.75 percent. Analysts now expect the Fed to cut more gradually in 2025 than anticipated in September, as the economy’s fundamentals remain robust

My office also issues an Annual Comprehensive Financial Report as an accounting supplement to the budgetary report. This annual report includes financial statements for all state funds and component units prepared in accordance with Generally Accepted Accounting Principles (GAAP). From a balance sheet perspective, the GAAP unassigned fund balance in the General Fund was a negative $643.9 million as of June 30, 2023

If you have any questions on this report, please do not hesitate to contact me.

Sincerely,

Sean Scanlon

State Comptroller