November 1, 2024

The Honorable Ned Lamont

Governor of the State of Connecticut

State Capitol

Hartford, Connecticut

Dear Governor Lamont,

I write to provide you with financial statements for the General Fund and the Transportation Fund through September 30, 2024. The Office of the State Comptroller (OSC) is projecting the General Fund will end Fiscal Year 2025 with a $71.2 million surplus and the Special Transportation Fund will end Fiscal Year 2025 with a $131.6 million surplus. OSC is in general agreement with the Office of Policy and Management’s (OPM’s) General Fund and Special Transportation Fund projections. The following analysis of the financial statements furnished by OPM is provided pursuant to Connecticut General Statutes (CGS) Section 3-115.

General Fund

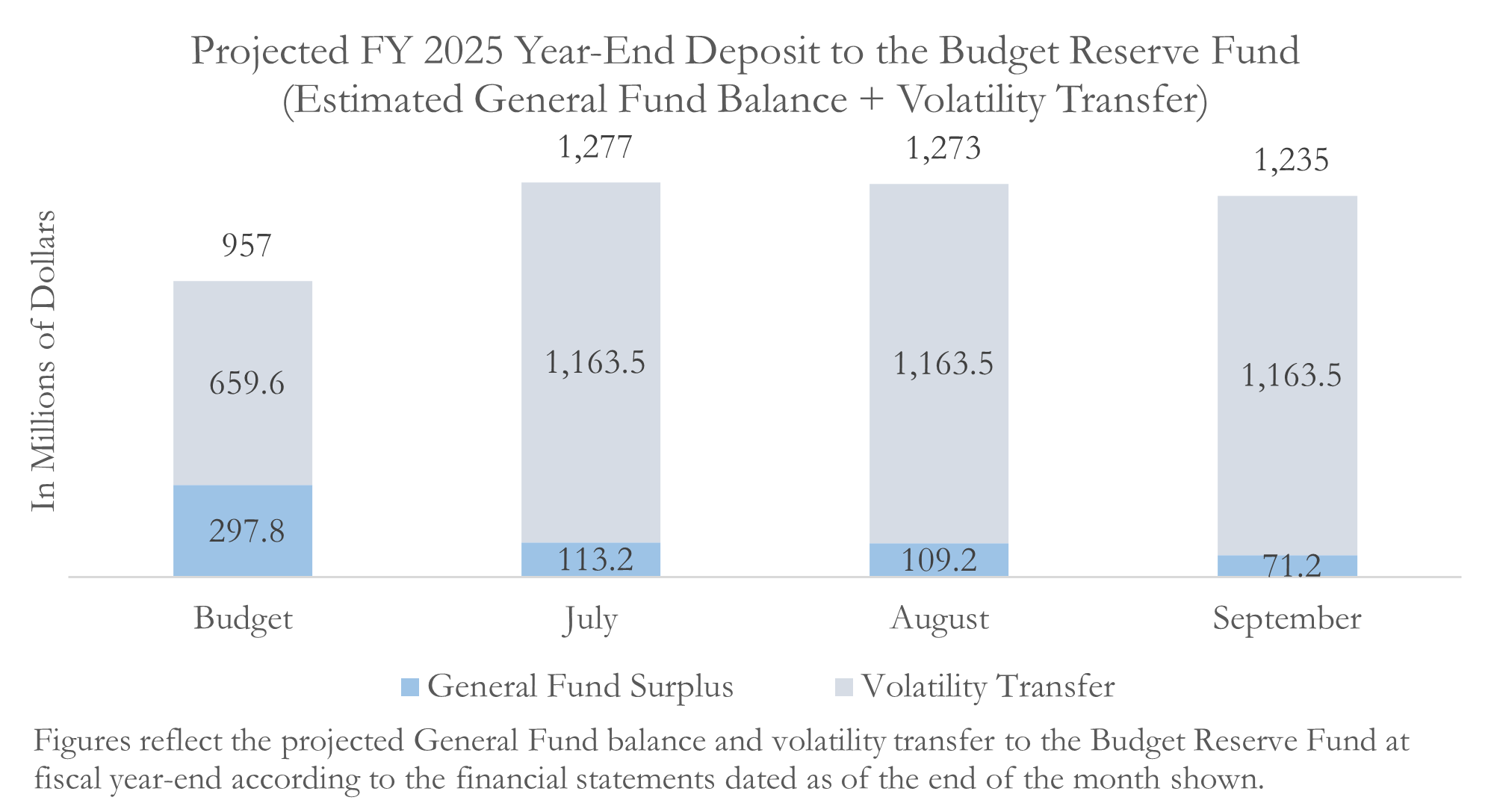

The FY 2025 General Fund surplus is projected to be $71.2 million, which is $38.0 million lower than last month’s projection and $226.6 million lower than budgeted. The change from last month is due to projected expenditures being $38.0 million higher, largely due to higher Personal Services costs across various agencies. Projected revenues are unchanged from last month.

Special Transportation Fund

The Special Transportation Fund (STF) is projected to close FY 2025 with a $131.6 million operating surplus, an increase of $4.2 million from last month’s projection due to lower projected expenditures. Following the use of a portion of the STF fund balance described below and FY 2025 operations, the STF closing balance is projected to be $543.1 million, as of June 30, 2025.

Public Act No. 24-151 requires the portion of the FY 2024 year-end STF fund balance above 18 percent of FY 2025 net appropriations be used to reduce the state’s transportation-related indebtedness. That amount is currently projected to equal $526.9 million.

Budget Reserve Fund

For the closeout of FY 2024, $933 million is estimated to be transferred out of the Budget Reserve Fund (BRF) and into the State Employees’ and Teachers’ Retirement systems this year.

For FY 2025, year-end transfers totaling $1.23 billion from the volatility cap deposit and operating surplus are projected to increase the BRF balance to 23.4 percent of General Fund appropriations. Since the statutory cap for the BRF is 18 percent, the projected balance is anticipated to result in additional transfers to the retirement funds during the closeout of FY 2025.

Economic Indicators

The U.S. economy continues to exceed expectations with solid growth. Real Gross Domestic Product (GDP) grew at a 2.8 percent annual rate in the third quarter according to the first Bureau of Economic Analysis estimate, following healthy 3.0 percent growth in the second. Consumer spending remains robust, with retail sales increasing 0.4 percent for the month in September.

Inflation continues to moderate. Consumer prices rose 2.4 percent year-over-year in September, down from 2.5 percent last month. While consumer prices have risen an uncomfortable 21.3 percent overall since January of 2020, disposable personal incomes have grown 29.3 percent, supporting economic growth.

U.S. employers added a surprisingly high 254,000 jobs in September, about 100,000 more than economists had projected. The unemployment rate fell to 4.1 percent and previous months’ job gains were revised higher. While the labor market has cooled over the past year, the recent data suggests that concerns about serious deterioration may have been overblown. This could slow the pace of the Federal Reserve’s interest rate cuts in the coming months, following their first large 0.5 percentage point cut in September.

Connecticut’s labor market is strong. The unemployment rate fell to 3.2 percent in September, the sixth consecutive month of declines, while average weekly earnings grew 8.0 percent from last year. The Professional and Business Services sector led growth by adding 1,800 jobs in September, though total employment declined slightly by 300 jobs. The size of the state’s labor force remains a crucial factor for future employment growth, especially as Baby Boomers reach peak retirement age.

U.S. sales of existing homes remained subdued in September, while sales of new homes increased 4.1 percent from August. The housing market in Connecticut remains competitive, with homes selling at 102.5 percent of their list price on average, and at a median price that is 11.3 percent more than last year according to Redfin. Inventory increases suggest that price growth could moderate in the coming months.

Potential homebuyers hoping the Federal Reserve’s rate cut would translate to lower mortgage rates were mostly disappointed in October. Mortgage rates tend to move with 10-year Treasury bond yields, which depend on market expectations for economic growth and future Fed policy. Strong economic data reported in October caused financial markets to recalibrate the anticipated speed and depth of interest rate reductions over the next several years, pushing average 30-year fixed rate mortgage rates up 64 basis points from recent lows in the process.

Over time, lower interest rates are expected to boost new home construction, which should help improve housing affordability in the long-term by increasing the supply of homes. Connecticut permits to build new units were up sharply in September.

My office also issues an Annual Comprehensive Financial Report as an accounting supplement to the budgetary report. This annual report includes financial statements for all state funds and component units prepared in accordance with Generally Accepted Accounting Principles (GAAP). From a balance sheet perspective, the GAAP unassigned fund balance in the General Fund was a negative $643.9 million as of June 30, 2023.

If you have any questions on this report, please do not hesitate to contact me.

Sincerely,

Sean Scanlon

State Comptroller