June 1, 2023

The Honorable Ned Lamont

Governor of the State of Connecticut

State Capitol

Hartford, Connecticut

Dear Governor Lamont,

I write to provide you with financial statements for the General Fund and the Transportation Fund through April 30, 2023. The Office of the State Comptroller (OSC) is projecting the General Fund will end Fiscal Year 2023 with a $1.6 billion surplus, an increase of $16.1 million from last month, and the Special Transportation Fund will end Fiscal Year 2023 with a $251.1 million surplus, an increase of $2.3 million from last month.

The following analysis of the financial statements furnished by OPM is provided pursuant to Connecticut General Statutes (CGS) Section 3-115. The Office of the State Comptroller is in general agreement with OPM’s General Fund and Special Transportation Fund projections which reflect the consensus revenue forecast reached with the Office of Fiscal Analysis (OFA) on May 1, 2023.

No changes have been made to the consensus revenue forecast for either the General Fund or the Special Transportation Fund. Decreases in expenses for both funds is primarily due to vacancies.

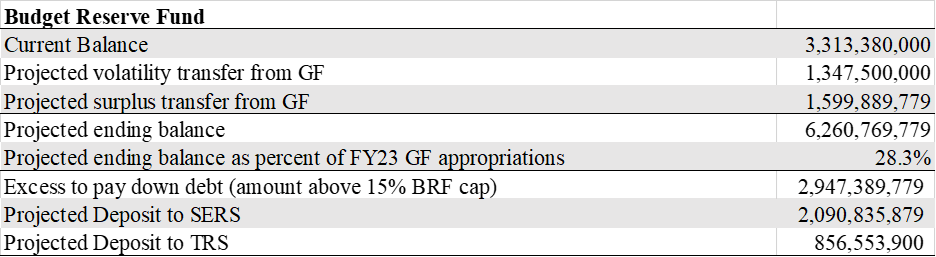

Budget Reserve Fund

The statutory revenue volatility cap requires receipts above a certain level to be transferred to the Budget Reserve Fund (BRF). OSC is currently projecting approximately $2.9 billion would be available to reduce unfunded pension liability for the State Employee Retirement System (SERS) and the Teachers’ Retirement System (TRS).

Economic Indicators

As of the release of this letter, it appears that the United States will meet the June 5 deadline set by the Treasury Department to act or risk default. The bipartisan deal struck by President Joe Biden and House Speak Kevin McCarthy would extend the debt limit for 2 years.

A few highlights from the deal are as follows:

- Social security, Medicare and Medicaid remain untouched

- Climate and clean energy provisions of last year’s Inflation Reduction Act are preserved

- President Biden’s executive action on student debt forgiveness is unchanged

- $28 billion in unspent Covid relief funds will be rescinded

- Federal student loan repayments, which have been delayed since the start of the pandemic, will restart

- Work requirements will be added for certain individuals participating in the Supplemental Nutrition Assistance Program (SNAP) and Temporary Assistance for Needy Families

- Updates to streamline permitting for projects will be made to the National Environmental Policy Act (NEPA)

Debt ceiling notwithstanding, the Connecticut economy remains strong. On May 18, 2023, Governor Ned Lamont and Treasurer Erick Russell announced that the Kroll Bond Rating Agency had upgraded the State of Connecticut’s General Obligation bond credit rating from AA (stable) to AA+ (stable). This follows an upgrade by S&P in 2022 and four additional upgrades in 2021 by all four of the major credit rating agencies. Prior to this Connecticut had not experienced an upgrade in its credit rating since February 2001.

In other economic news, as expected the Federal Reserve increased interest rates by 25-basis-points on May 1st, bringing the benchmark rate above 5% for the first time since 2007. Economists are hopeful that the Federal Reserve will hold rates steady for the rest of the year.

Fed Chair Jerome Powell has pledged to bring inflation down to the central bank’s 2% target “because we know in the longer run that that is the thing that will most benefit the people we serve,†he said recently. The Consumer Price Index (CPI) rose 4.9%, the first reading below 5% in two years, suggesting the Fed is winning its inflation battle.

Connecticut payroll was down 900 jobs in April, driven by early hiring in January and February due to the mild winter. Still, Connecticut has gained 11,300 jobs to-date in 2023. The Connecticut unemployment rate was 3.8% in April, down from 3.9% in March.

Berkshire Hathaway HomeServices reported year-over-year sales of single-family homes in Connecticut decreased 31.9% and new listings were down 31.8% in April. Median selling price increased by 5.4% and median listing price increased by 7.7%. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.35% as of May 11, up 5.3% from one year ago. The median rent for all bedroom and all property types in Connecticut is $1,900, a decrease of $94 year-over-year, according to Zillow Rental Data.

From a balance sheet perspective, the GAAP unassigned fund balance in the General Fund was a negative $771.5 million as of June 30, 2022.

If you have any questions on this report, please do not hesitate to contact me.

Sincerely,

Sean Scanlon

State Comptroller