August 1, 2023

The Honorable Ned Lamont

Governor of the State of Connecticut

State Capitol

Hartford, Connecticut

Dear Governor Lamont,

I write to provide you with financial statements for the General Fund and the Transportation Fund through June 30, 2023. Fiscal Year 2023 officially ended on June 30, 2023, which is followed by an adjustment period ending in August with audited results available by December 31, 2023. The Office of the State Comptroller (OSC) is projecting the General Fund will end Fiscal Year 2023 with a $630.6 million surplus, a decrease of $115.3 million from last month, and the Special Transportation Fund will end Fiscal Year 2023 with a $267.9 million surplus, an increase of $7.7 million from last month.

The following analysis of the financial statements furnished by OPM is provided pursuant to Connecticut General Statutes (CGS) Section 3-115. The Office of the State Comptroller is in general agreement with OPM’s General Fund and Special Transportation Fund projections.

The $115.3 million decrease in General Fund surplus is the result of a $160.0 million decrease in revenue projections partially offset by a $44.6 million decrease in projected expenditures. Federal Grants revenue has been revised downward by $139.8 million due to anticipated timing differences in the receipt of Medicaid revenue and a revised estimate for the ARPA Home and Community – Based Services (HCBS) initiative. In addition, Miscellaneous Taxes has been revised downward by $67.1 million to reflect attribution to appropriate tax types in FY 2023, and Personal Income Tax – Estimates and Finals have been revised downward by $50.0 million. Partially offsetting these declines are upward revisions to both the Corporation Tax and Pass-through Entity Tax by $35.0 million each.

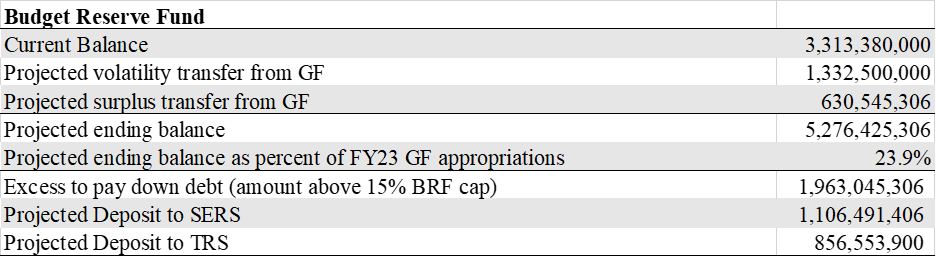

Budget Reserve Fund

The statutory revenue volatility cap requires receipts above a certain level to be transferred to the Budget Reserve Fund (BRF). OSC is currently projecting approximately $1.96 billion would be available to reduce unfunded pension liability for the State Employee Retirement System (SERS) and the Teachers’ Retirement System (TRS).

In addition, there was a change included in the state budget for Fiscal Year 2023 that allows any SERS fringe benefit over-recoveries to remain in the SERS Fund as an additional state contribution. In past years, over-recoveries would be transferred to the General Fund and credited as revenue. We have calculated this amount to be $72.0 million for Fiscal Year 2023.

Economic Indicators

After three years of a global pandemic that sent unemployment surging and plummeting, and a bout of inflation that saw prices grow at their fastest pace since the 1980s, the Federal Reserve began a series of interest rate hikes in March 2022. As they issued consecutive rate hikes over the course of the next year, there was broad concern that the Federal Reserve would go too far in raising interest rates and tip the economy into recession.

However, with inflation slowing (in June the 12-month Consumer Price Index decreased to 3%, not far from the Federal Reserve’s 2% target) and the job market remaining robust, it appears that the Federal Reserve may be close to declaring victory, and in fact Chairman Powell told reporters on July 25th that they were no longer forecasting a recession.

Turning to Connecticut, while employers lost 4,600 jobs in June, the decrease was attributed in large part to employment growth in May that was much stronger than expected. In fact, the largest June job declines were in the same industries with strong May job gains. To date Connecticut has gained 14,100 jobs in 2023, more jobs than added in the first six month of any pre-pandemic year since 2006. Overall, Connecticut has recovered 96.4% of the 289,400 nonfarm jobs lost in March and April 2020 due to the COVID-19 lockdown (the provide sector is 98.1% recovered from the pandemic shutdown). Connecticut unemployment remains at 3.7%, while employers currently have more than 90,000 jobs available.

From a balance sheet perspective, the GAAP unassigned fund balance in the General Fund was a negative $771.5 million as of June 30, 2022.

If you have any questions on this report, please do not hesitate to contact me.

Sincerely,

Sean Scanlon

State Comptroller