April 3, 2023

The Honorable Ned Lamont

Governor of the State of Connecticut

State Capitol

Hartford, Connecticut

Dear Governor Lamont,

I write to provide you with financial statements for the General Fund and the Transportation Fund through February 28, 2023. The Office of the State Comptroller (OSC) is projecting the General Fund will end Fiscal Year 2023 with a $1.42 billion surplus and the Special Transportation Fund will end Fiscal Year 2023 with a $237.4 million surplus. OSC’s General Fund projection varies from the Office of Policy and Management (OPM) due to inclusion of $12 million adjudicated claim to settle a child welfare case. OSC is in general agreement with OPM’s Special Transportation Fund projection. The following analysis of the financial statements furnished by OPM is provided pursuant to Connecticut General Statutes (CGS) Section 3-115.

General Fund

The General Fund surplus is projected to be $1.42 billion which is an increase of $71.4 million from last month’s projection. This month’s estimate reflects a $57 million upward revision in projected revenue, with the most significant increases in Indian Gaming Payments as well as Insurance Companies tax revenue. In addition, there was a net downward revision of expenditure requirements of $14.4 million, primarily due to several Personal Services accounts expected to lapse due to vacancies and partially offset by expenditures for Adjudicated Claims.

Special Transportation Fund

The Special Transportation Fund surplus is projected to be $237.4 million, an increase of $3.2 million from last month’s projection. Transportation Fund revenues were revised upwards by $5 million primarily due to higher Interest Income partially offset by lower projected License, Permit and Fee revenue. Expenditures were revised upwards primarily due to a projected shortfall in the Insurance and Risk Management Operations account as a result of premium increases and the anticipated settlement of several large claims.

Budget Reserve Fund

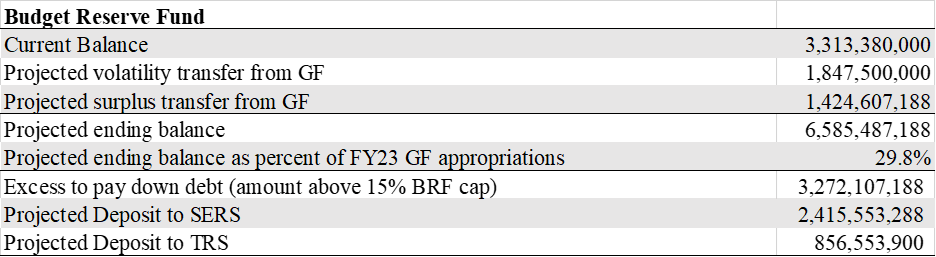

The statutory revenue volatility cap requires receipts above a certain level to be transferred to the Budget Reserve Fund (BRF). OSC is currently projecting approximately $3.3 billion would be available to reduce unfunded pension liability for the State Employee Retirement System (SERS) and the Teachers’ Retirement System (TRS).

Economic Indicators

The U.S. banking system is “sound and resilient” Fed Chair Jerome Powell declared on March 22, 2023, as the Federal Reserve raised interest rates by a quarter of a percentage point, bringing the federal funds rate to a targeted range of 4.75% to 5.00% (the highest level in 15 years). With the recent collapse of two U.S. banks, Silicon Valley Bank and Signature Bank, some speculated if the Federal Reserve might pause rate hikes.

The Fed originally appeared set for a steeper rate hike, so the 25 basis points shows its continued resolve to reach a 2% inflation target rate while at the same time being mindful of its role as the banker’s bank. The Bureau of Labor Statistics reported the Consumer Price Index (CPI) rose 0.4% in February on a seasonally adjusted basis, after increasing 0.5% in January. Over the last 12 months, the all items increased 6.0%, down from 6.4% in January.

The economy added another 311,000 jobs in February. Unemployment increased from 3.4% to 3.5% in February but is still among the lowest levels in more than 50 years. United States unemployment claims as of the latest Unemployment Insurance Weekly Claims report were 196,000, after surpassing 200,000 for only one week earlier in March (the long-term average is closer to 350,000). There were about 10.8 million job openings in February with unemployment at 5.9 million, still nearly 2 jobs for every unemployed person. The labor force participation rate (number of individuals which are actively seeking out work or who are already employed) edged up to 62.5% in January 2023 but remains approximately 1.0 percentage points below its value in February 2020, prior to the pandemic (participation rate has been singled out by Chairman Powell as one lynchpin of his staff’s current view of the economy).

The National Association of Realtors (NAR) reported existing-home sales increased 14.5% in February, breaking a 12-month slide and representing the largest monthly percentage increase since July 2020 (but is still 22.6% below last year). The median existing-home sales price was $363,000 in February, a little higher than January but a decline of 0.2% from February 2022, ending a streak of 131 consecutive months of year-over-year increases, the longest on record. However, in Connecticut sales of single-family homes decreased 27.9% and new listings were down 20.7% in February. Year-over-year rent growth is continuing to decelerate and now stands at 3%, its lowest level since April 2021. The vacancy index now stands at 6.4%, its highest reading in two years.

My office also issues an Annual Comprehensive Financial Report as an accounting supplement to the budgetary report. This annual report includes financial statements for all state funds and component units prepared in accordance with Generally Accepted Accounting Principles (GAAP). From a balance sheet perspective, the GAAP unassigned fund balance in the General Fund was a negative $771.5 million as of June 30, 2022.

If you have any questions on this report, please do not hesitate to contact me.

Sincerely,

Sean Scanlon

State Comptroller